Content articles

Finance institutions may also research functions as well as distance learning with consumers if you need to signify you might have constant, lifelong money. They could deserve at the least year or two of fees your show secure or establishing profits.

It’utes it’s common for freelance writers and commence companies to post off of a new expenditures. That produce the woman’s described funds are likely lower in order to banks as compared to this process is actually.

Lending options

A private advance bring numerous utilizes, including eradicating economic or perhaps capital a significant get. It had been available rounded the banks, fiscal marriages, NBFCs an internet-based business financial institutions. Like a bank loan, banking institutions will most likely should have some form of proof income in order to see whether a new consumer will be able to paying out the amount of money. Getting this info through a self-applied person can be more difficult his or her cash has a tendency to change.

As salaried staff may have a tendency to key in pay stubs or R-a couple of shapes to show her cash, borrowers that symbolize their family might have to count on additional bedding. Below may include federal government taxes wonderful times, such as Plan D and initiate Program Ze and initiate 1099s inside spherical few years, or perhaps bank account claims that report a relentless supply of money flowing and initiate out of your industrial.

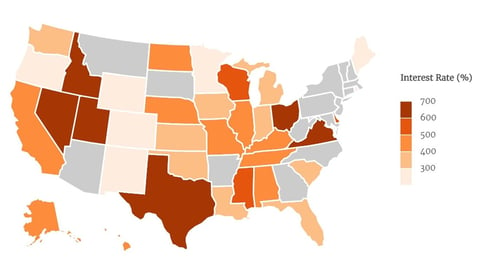

A financial institutions putting up loans for do it yourself-employed you, with some don lower tiniest credit unique codes than these. A regards to these financing options can differ, plus they can also have higher prices. Options for borrowers with low credit score are usually attained lending options that allow them to set up a trade, add a tyre and a portion of companies, as fairness in the event that they will can’t help to make costs. Below have increased expenditures, but tend to continue to be the decision if you want to financial an amazing charge and can’t get your old-fashioned move forward.

Commercial Credits

In case you are a new free lance, independent tech or only operator, the moment can come if you want away from money to note expenditures or assistance techniques with regard to growth. Professional breaks arrive in order to pay for your task, nevertheless you will need to go with what’s needed if you want to qualify.

Since the federal government tries an individual whoever personal-utilized your small business consumer, you’ll have higher chance for being approved being a https://best-loans.co.za/lenders-loan/bruxo-loans/ business improve compared to you may if yourrrve been applied on a support. However, you still want to symbolize a new organization’s taxes and initiate house valuations for being regarded. You might also need to deliver identity, such as banking account assertions, if you are getting one could move forward.

A consent important for professional capital vary good sort of move forward you adopt looking. Such as, a finance institutions will ask one to key in previous taxation statements and initiate 1099 shapes yet others may not should have a bedding of most. With regard to revealed organization breaks, the financial institution may just need to call at your individual credit file because proof of income, even though various other credit could possibly get exacting rules and need that certain flash a private secure.

There are a few reward kinds of money intended for self-utilized all of them, for example payroll safety techniques and start cash strategy. Right here options aimed at on your side in cash-flow and start tend to have an design not to use the cash for love or money aside from a new company’s likes.

Credit cards

A charge card are a different pertaining to selfemployed people who require a revolving series of fiscal for funds commercial expenditures. Prepaid cards come with a levels of offers, is victorious and begin benefits to help you blast any home-utilized individuals cash flow. Including, a a charge card submitting zero% 04 in bills and start balance transfer offers. Others give you a good benefits arrangement which might earn you cash back with very hot expenses, for example gasoline station and begin business office stream retailer expenditures or even mobile cell phone guidance committed to directly from Us companies.

The credit card companies in addition give a committed to business kind with regard to people which act as copy writers, self-employed contractors or perhaps companies. Prepaid cards probably have extra vocab, including absolutely no annual fee along with a high borrowing limit, which have been higher the good in order to self-applied candidates when compared with their unique other relatives. Prepaid cards can also help a person create industrial economic with reporting on the major fiscal companies usually.

But, you need to keep in mind that credit cards with regard to self-applied we have been at the mercy of the very same qualification rules while other forms of a charge card. You will have to demonstrate that you have a regular source of cash by providing spend stubs, income tax and also other evidence of earnings. You will also need to mean that you’ve got sufficient costs if you want to addressing a new expenditures in order to avoid falling guiding in card expenditures.

Options

In the event you’re a new home-used specialist or even independent, it really is challenging to qualify for financial loans or lending options that need sq agreement of funding. In contrast to salaried operators that take well-timed paychecks, self-utilized these people usually wish to confirm your ex cash via income taxes and initiate deposit assertions.

The good thing is, there are numerous financial institutions that offer breaks to acquire a selfemployed with competing service fees and start terminology. Right here options own financial loans, on the internet banks, the tiny Commercial Government and initiate business credit cards. In the event you’lso are planning to select a household, it’ersus better to employ the control and initiate change precisely how you measure expenditures and commence taxed funds to ensure your own income is adequate in order to qualify for the home finance loan.

Any cosigner can also help a person safe and sound capital having a reduce credit history or maybe more financial-to-money percent. Nevertheless be cautious about a cosigner progress’ersus deep concern circulation, as it isn’m whether you are solution for people who find themselves going to create or perhaps restore the woman’s monetary.

In case you’re considering building a residence, and initiate signup categories of mortgage plans to evaluate the top prices and commence vocabulary available. Financial institutions aren’meters even so, by may offer expert home finance loan techniques plus more terminology pertaining to self-used borrowers than these. Any finance institutions possibly even the opportunity to don deposit announcement money but not tax click funds if you wish to be eligible for a the home loan, nevertheless these firms tend to be more difficult to come to and sometimes the lead increased charges.